24+ Salary to mortgage ratio

The sum will be divided by 24 months to find your. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

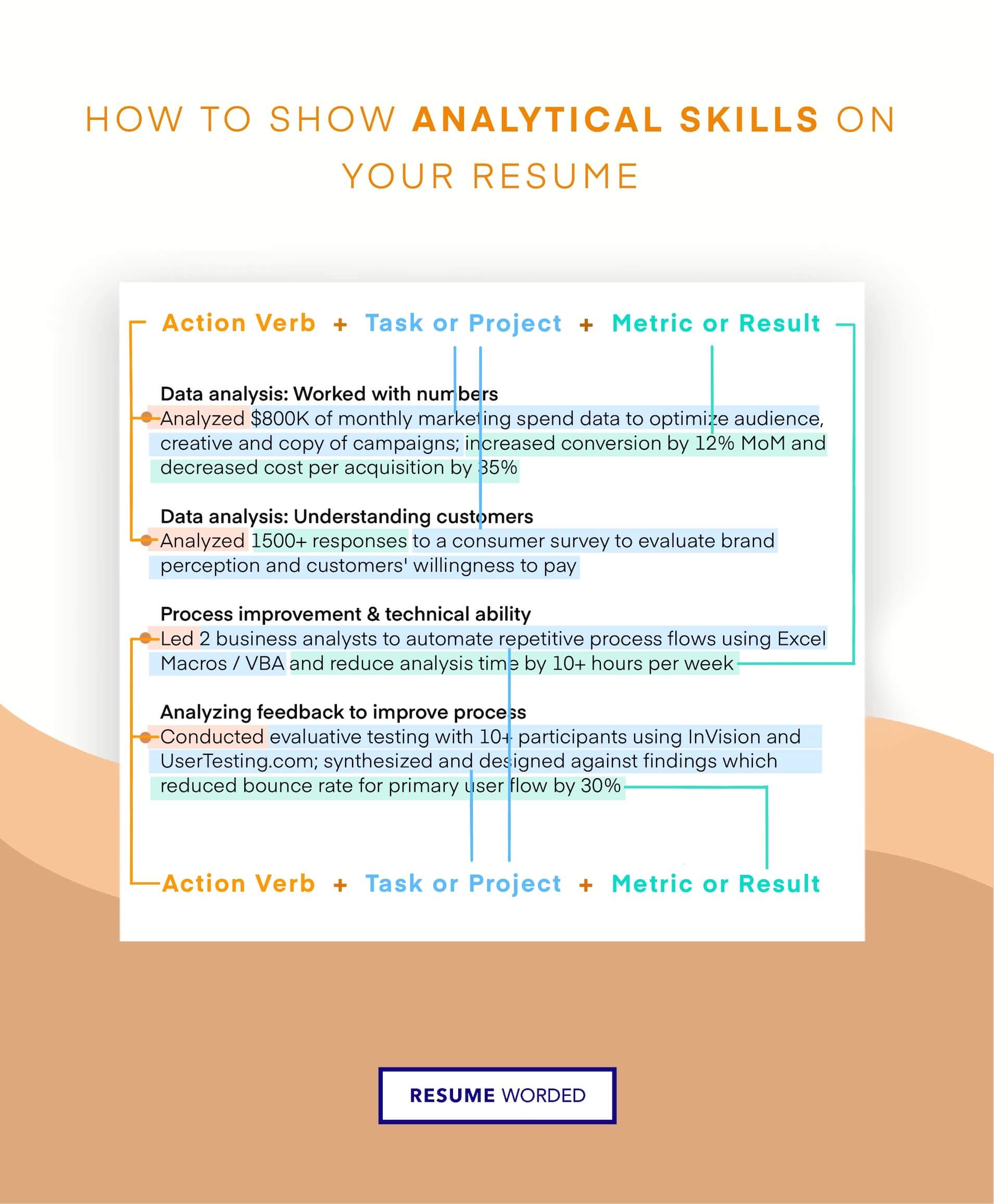

Underwriter Resume Example For 2022 Resume Worded

Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income.

. Thats a 120000 to 150000 mortgage at 60000. The 28 Rule The 28 rule says that you shouldnt pay. To qualify for a USDA loan your total debt-to-income DTI ratio should be no more than 41.

Browse Information at NerdWallet. The standard salary to mortgage ratio used by lenders is 45 times an annual salary. 2 days agoDebt-to-income DTI Ratio.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Take Advantage And Lock In A Great Rate. Were not including additional liabilities in estimating the income.

The maximum debt-to-income ratio will vary by mortgage lender loan program and investor but the number generally ranges between 40-50. Ad Learn More About Mortgage Preapproval. To determine how much you.

In this example you shouldnt spend more than 1680 on your monthly. Take Advantage And Lock In A Great Rate. These tables give you an at-a-glance guide to the amount you might be able to borrow on your salary.

Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage. The total debt ratio also known as the back-end ratio is the housing expense plus other monthly debt payments all divided by the borrowers gross monthly income.

The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Lock Your Mortgage Rate Today. If you earn 250000 or more the same multiples will apply so simply.

Compare Offers Side by Side with LendingTree. Keep your total debt payments at or below 40 of your pretax monthly income. Additionally your monthly housing-related expenses.

Principal interest taxes and insurance. Ad Step-by-Step Instructions on How to Complete Your Sample Mortgage Form Today. Browse Information at NerdWallet.

Thanks to the new. Ad Compare Your Best Mortgage Loans View Rates. As an example some homebuyers may opt for a 15-year or 30-year fixed home mortgage.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. This percentage strikes a good balance between buying the. Get the Right Housing Loan for Your Needs.

Apply Now With Quicken Loans. Now multiple your gross monthly income by 028 to determine how much you should spend on a mortgage each month. Lender Mortgage Rates Have Been At Historic Lows.

How much do I need to make to buy a. You will pay off the loan earlier with a 15-year term. Lender Mortgage Rates Have Been At Historic Lows.

There are a few different more popular models for determining how much of your income should go to your mortgage. 614K minus the 50K down. This means you can potentially borrow 45 times your annual salary as a mortgage.

2 days agoLower your debt-to-income ratio. Create Your Free Mortgage Form. Ad Were Americas Largest Mortgage Lender.

Ad Learn More About Mortgage Preapproval. A borrower with a. Compare Mortgage Options Calculate Payments.

The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. At Rocket Mortgage the percentage of income-to-mortgage ratio we recommend is 28 of your pretax income.

Ms Excel Mortgage Qualification Worksheet Template Excel Templates Worksheet Template Excel Templates Worksheets

Ms Excel Mortgage Qualification Worksheet Template Excel Templates Worksheet Template Excel Templates Worksheets

Dopedollar Com Budgeting Worksheets Budget Spreadsheet Template Budget Spreadsheet

10 Best Quick Personal Loans To Get Fast Emergency Cash Immediately

What Caused The Housing Market Crash Quora

2

Nc10018789x1 Pieericksox3 Jpg

Boa Acquisition Corp Merger Prospectus Communication 425

9 Household Budget Worksheet Templates Pdf Doc Free Premium Templates

Awesome Debt Management Template Debt To Income Ratio Spreadsheet Template Excel Spreadsheets Templates

5 Practical Ways To Increase Your Take Home Salary Pay Salary Online Work From Home Work From Home Jobs

The Doomsday Warnings About The Us Housing Market Are Getting It Backward Housing Market 30 Year Mortgage Business Insider

Boa Acquisition Corp Merger Prospectus Communication 425

What Specific Event Happened That Triggered The Meltdown Of Housing Market In 2008 Quora

Pdf Locked Out Unemployment And Homelessness In The Covid Economy

Tumblr Home Equity Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Mortgage Loans